The IMF’s CHANGE in its forecasts for China’s growth this year and next go in opposite directions to those for the global economy as a whole.

In the new edition of its World Economic Outlook, The Fund projects 6.3% GDP growth this year and 6.1% in 2020. That is a one-tenth of a percentage point increase and reduction respectively on the Fund’s forecast in January, which in turn was unchanged from its forecast last October. However, for the world economy, it has cut its projections for this year but sees faster expansion in 2020.

The upgrade to the China forecast for this year is in large part technical. The Fund has dropped the assumption made in its previous forecast that the US tariff rate on $200-billion worth of trade would rise as threatened by the Trump administration to 25% from 10%.

China’s growth had started slowing in the second half of 2018 as a result of the measures to deleverage and rein in shadow banking, and the increase in trade tensions with the United States. At the same time, the consequent slower domestic investment was accompanied by softening consumption, particularly for cars, whose sales declined with the ending of incentive programs. The economy expanded by 6.8% in the first half of 2018, but by only 6.0% in the second.

For this year, the Fund expects economic conditions to improve as stimulus kicks in. Nonetheless, the external environment will be challenging: the advanced economies are slowing down; trade tensions with the United States are likely to persist regardless of any deal being struck in the near future, and there is likely to be a gradual tightening of financial conditions consistent with some further removal of monetary policy accommodation by the US Federal Reserve.

Even assuming no further increase in tariffs and a continuation of fiscal stimulus by Beijing, China’s economic growth is projected to slow this year and into next as the underlying forces that slowed growth in the second half of last year persist.

Longer term, the Fund sees a gradual slowing of the economy to 5.5% annual GDP growth by 2024. This is assuming the successful continuation of rebalancing towards a private-consumption and services-based economy and of the authorities’ actions to slow the accumulation of debt and mitigate its associated vulnerabilities.

This Bystander has less confidence in the second assumption than in the first. Cuts to personal income tax and value-added tax for small and medium enterprises should help stimulate domestic consumption. However, authorities also eased back on deleveraging and injected liquidity through

cuts in bank reserve requirements.

Any excessive stimulus to support near-term growth through a loosening of credit standards or a resurgence of shadow banking activity and off-budget infrastructure spending would heighten financial vulnerabilities — another reason that President Xi Jinping may be anxious to secure a deal with US President Donald Trump sooner rather than later.

If no deal is reached with the United States, that will cast a dark shadow over the medium-term outlook.

The Fund acknowledges that some centrally financed on-budget fiscal expansion in 2019 may be appropriate to avoid a sharp near-term growth slowdown that could derail the overarching reform agenda. However, it says this should avoid large-scale infrastructure stimulus and instead “emphasize targeted transfers to low-income households so as to lower poverty and inequality”.

It also lays out its familiar shopping lists of structural reforms:

Reducing leverage in the economy will require:

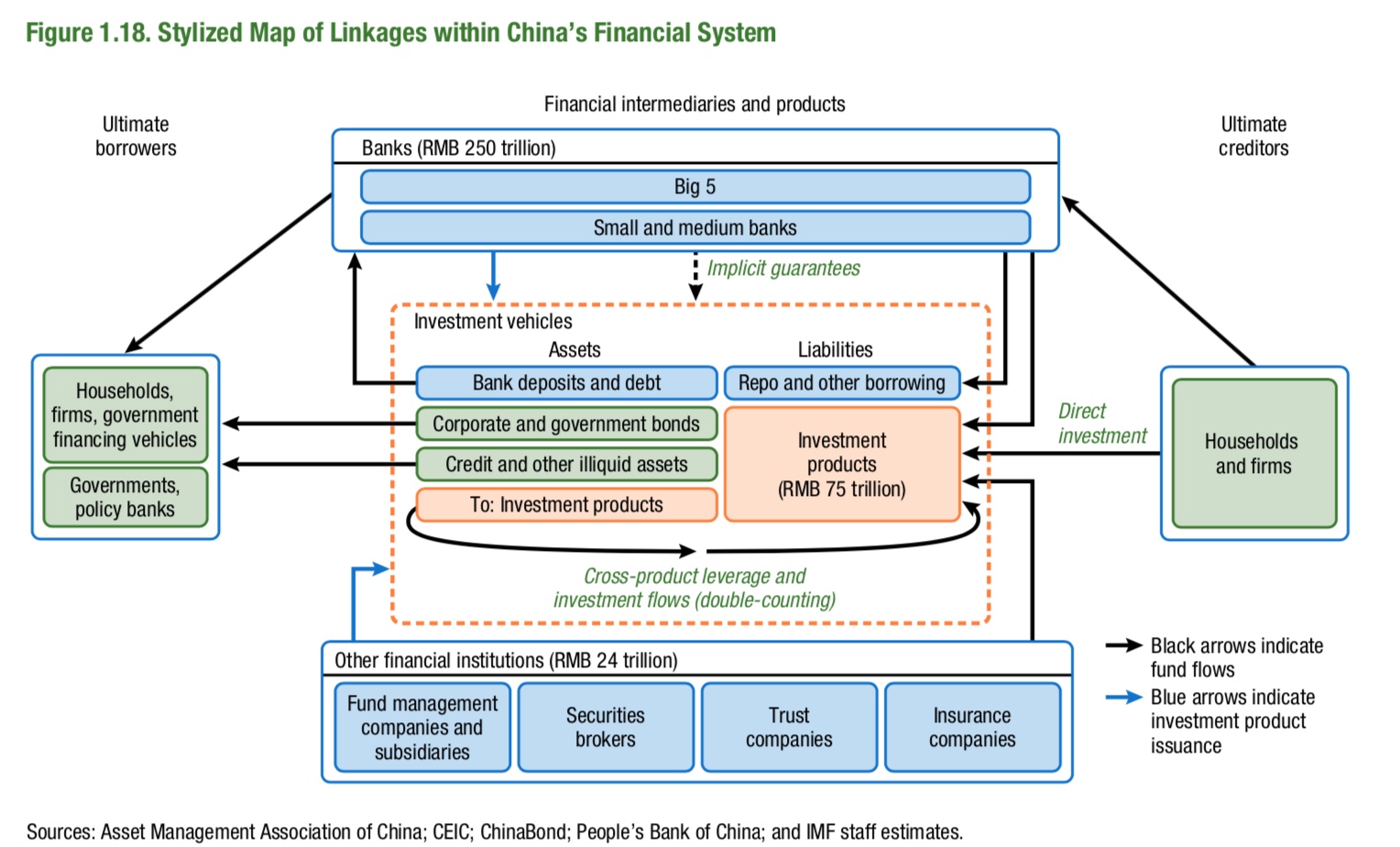

⁃ continued scaling back of widespread implicit guarantees on debt;

⁃ early recognition and disposal of distressed assets; and

⁃ fostering more market-based credit allocation that better aligns risk-adjusted returns with borrowing costs.

Continued rebalancing will require:

⁃ a more progressive tax code;

⁃ higher spending on health, education, and social transfers; and

⁃ reduced barriers to labour mobility.

Enhancing productivity growth will require:

⁃ reducing the footprint of state-owned enterprises; and

⁃ further lowering barriers to entry in certain sectors, such as telecommunications and banking.

As an endnote, the World Economic Outlook devotes a whole chapter to the link between bilateral trade tariffs and trade imbalances, and questions whether bilateral trade imbalances can (or should) be addressed using bilateral trade measures. Its conclusion is a rebuff to US President Donald Trump’s stated intention of using tariffs to cut the US trade deficit with China. It concludes that:

Targeting bilateral trade balances will likely only lead to trade diversion, with limited impact on country-level balances. The findings of this chapter help explain why, despite the tariff measures, the US trade deficit is the largest it has been since 2008. The chapter also establishes that the negative impact of tariffs on output is significantly higher today than in 1995 owing to the bigger role of global supply chains in world trade.

The paradox is that Trump’s tariffs will not achieve their stated aim of achieving balanced trade and have imposed a cost on US manufacturers and farmers, bu have got Beijing to the table to negotiate over structural reforms to its development model that it has never been prepared to talk about before.